Luminar: Which Is The Better Lidar Stock? See our analysis below of how Luminar compares to Velodyne, a company that has focused on lidar for lower volume applications. The stock also remains one of the few pure-play options in the self-driving market. Although none of these developments directly impact Luminar, the company is seen as a technology leader for lidar in mass-market vehicles and does stand to benefit as EVs and self-driving vehicles continue to gain traction. Apple AAPL is also rumored to be developing its own electric car, and there have been reports that it held meetings with EV startup Canoo (NASDAQ: GOEV) in this regard. Separately, Chinese e-commerce titan Alibaba BABA unveiled an electric sedan under a new brand in collaboration with state-owned SAIC Motor SAIC. For instance, there is increasing enthusiasm surrounding legacy automaker General Motors GM’ EV plans, as the company formed a new business unit to sell electric vans and also saw Microsoft MSFT make an investment into Cruise, its autonomous-car division.

While there hasn’t been too much news specific to the company in recent weeks, the electric vehicle industry, which is leading the self-driving revolution, has seen a lot of buzz.

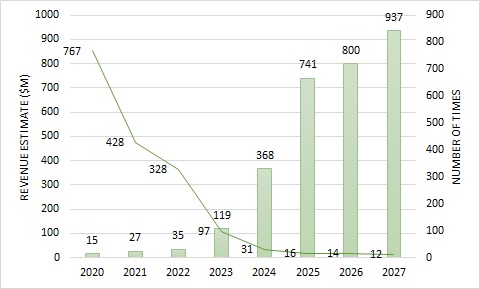

Luminar Technologies (NASDAQ: LAZR), a company that specializes in lidar technology used in self-driving vehicles, has seen its stock rally by about 15% since early January. Luminar: Which Lidar Stock Should You Pick? for an overview of the two companies’ valuation and fundamental performance in recent years. For example, Innoviz Technologies, an Israel-based lidar company is likely to go public sometime in Q1 this year via a SPAC merger, while other lidar players AEye and Aeva are also likely to go public shortly taking a similar route. However, there are a couple of other lidar players that are likely to go public this year and this could give investors more investment options, potentially reducing demand for Luminar stock. Given the growing competition and the company’s lack of a mass manufacturing track record, there is a lot of uncertainty.Īdditionally, Luminar’s lofty valuation is supported by the fact that its stock is one of the few pure-play options available to investors in the self-driving market. The company is projecting revenue of just $35 million in 2022 with the number rising to over $800 million by 2025. It is also going to be a while before Luminar starts generating meaningful revenue. Even Intel subsidiary MobileEye, which is currently a customer of Luminar, is looking to make its own lidar sensors by 2025. Velodyne Lidar (NASDAQ: VLDR), a company that has thus far focused on high-performance, high-cost lidar sensors, has developed a new mass-market sensor that it says can be produced for as little as $500. Now while Luminar’s technology appears well suited for mass-market self-driving cars, competition is also rising. Although lidar is seeing surging interest, driven partly by the big electric vehicle stock rally and an increasing commitment from legacy automakers to electrification and self-driving, we think investors should tread with caution with Luminar stock for a couple of reasons. Is the stock too risky at current levels? We think it is.

The company has a market cap of close to $11 billion, trading at about 400x consensus 2021 revenue.

Luminar Technologies (NASDAQ NDAQ: LAZR), a company that specializes in lidar technology that helps self-driving vehicles detect their surroundings, went public in December and now trades at about $34 per share, almost 3.5x its offer price.

0 kommentar(er)

0 kommentar(er)